Enrol Now by following the simple steps below!

Effective Presentation Skills

From internal presentations to sales pitches, customer segmentation presentations, and even motivational talks, effective presentation is essential to every business.Being able to get your point across clearly and concisely is an invaluable skill that helps businesses acquire new clients, build trust with existing clients, improve team morale, and ultimately foster long-term business growth and development.

Is your team equipped with the skills to deliver great presentations? Learn effective presentation techniques that great presenters use to engage, inspire, and influence your audience to take action. Learn how to become a polished presenter or public speaker by being able to structure presentations more effectively and apply verbal and non-verbal techniques to enhance presentation delivery. A convincing presentation can be a game-changer, and this presentation skills training course is tailored to help you achieve your presentation objectives.

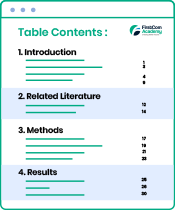

Course Outline

- Learn how to structure your presentations in a logical, easy-to-understand, and engaging manner to meet your presentation objectives.

- Learn to articulate your words with clarity and confidence, and discover how to adjust your voice, tone, rhythm, and volume to make an impactful and convincing presentation.

- Learn how to use body language, equipment, and resources at your disposal to communicate and reinforce your message in a customer segmentation presentation.

- Learn time management skills to ensure you deliver a presentation within a timeframe and respond to audience questions appropriately.

- Be able to objectively evaluate the effectiveness of a presentation.

Skills Acquired

- How to Present: Acquire practical skills in delivering presentations confidently & effectively

- Engaging Presentation Creation: Create captivating presentations that effectively communicate ideas

- Audience Connection Techniques: Learn various techniques to establish a strong connection with the audience during a presentation

- Adaptability in Presentations: Adapt presentations to different situations and audiences

Hands-on Learning Activities

- Presentation Brief Development: Develop a comprehensive presentation brief, outlining your presentation objectives.

- Presentation Slide Design &t Creation: Design visually appealing & impactful presentation slides for a convincing presentation.

- Conduct a 15-Minute Presentation: Put skills into practice by delivering a 15-minute convincing presentation, incorporating customer segmentation presentation techniques if applicable.

- Apply the techniques learned in the course, including engaging the audience, using body language effectively, & delivering a clear & persuasive message

Platforms & Tools Introduced

PowerPoint Slides

Competency Assessment

- Written & Practical

- Prepare & deliver a 15-minutes presentation based on what was taught throughout the course

Step 1 (Select Training Center)

Step 2 (Select Date)

- Select the time slot to enroll the course

- Available

- Selling Fast

- Full Enrollment

Course Fees & Subsidies

| SMEs | |

| Course Fees | |

| 70% SkillsFuture (SSG) Subsidy | |

| Nett Fee | |

| Non SMEs | |

| Course Fees | |

| 50% SkillsFuture (SSG) Subsidy | |

| Nett Fee | |

| Additional Support | ||||

Additional Support via Absentee Payroll |

||||

|

||||

Up to 90% Additional Subsidy from SkillsFuture Enterprise Credit (SFEC) |

||||

- Nett Fee is subject to 9% GST charged based on the full course fees before subsidy.

- Absentee payroll is claimable up to $4.50 per hour, capped at $100,000 per enterprise per calendar year.

- Subjected to individual company’s budget availability for the Enterprise Innovation Scheme. Each company can only either the 400% Tax Deduction option OR the 20% Cash Payout option. For more information, please refer to https://www.iras.gov.sg/schemes/disbursement-schemes/enterprise-innovation-scheme-(eis)

- Subjected to individual company’s budget availability for SFEC. For more information, please refer to https://www.enterprisejobskills.gov.sg/content/upgrade-skills/sfec.html

- Registered or incorporated in Singapore

- Employment size of not more than 200 (at group level) or with annual sales turnover (at group level) of not more than $100 million

| Singapore Citizens (40 years and above) | |

| Course Fees (Before GST) | |

| 9% GST | |

| 70% SkillsFuture (SSG) Subsidy | |

| Nett Fee | |

| Singapore Citizens (21-39 years old) & PR | |

| Course Fees (Before GST) | |

| 9% GST | |

| 50% SkillsFuture (SSG) Subsidy | |

| Nett Fee | |

| Additional Support | |

|

SkillsFuture Credits eligible for Singapore citizens aged 25 & above |

|

|

PSEA eligible for Singapore citizens aged below 30 |

|

|

NTUC UTAP members have up to 50% auto reimbursement on out-of-pocket cost |

|

- Nett Fee are inclusive of GST charged based on the full course fees.

- Subjected to individual’s eligibility and availability of SkillsFuture Credit.

- NTUC UTAP reimbursement is capped at $250 for members aged below 40 or $500 for members aged 40 & above.

Certification

3 Reasons Why We Can Ensure Maximum Skills Transfer Within 24 Hours of Training

Learn from and interact with certified trainers with years of proven training and industry experience

Localised syllabus and case studies co-curated with proven subject matter experts

FirstCom Academy partners up with many proven industry experts to develop short and effective courses built upon the Singapore’s landscape, allowing learners to learn based on familiar local context.

Unleash Your Potential with In-Person Training at Our Centers of Excellence

Elevate your skills through interactive learning experiences

Lifelong Learning Insitute (LLI) Training Center

Our training center at Lifelong Learning Insitute (LLI) makes use of the building’s state-of-the-art facilities and modern amenities to create a conducive environment for learning. As you step into our thematic classrooms centered around aspirational travel locations, you’ll be inspired to grow and empowered to succeed.

Conveniently located just a short sheltered walk away from Paya Lebar MRT Station, accessing the LLI Training Center is effortless for commuters. For those driving, the institute is easily reachable via PIE and ECP, with ample parking available.

Woods Square Training Center

Strategically located at Woods Square, our Woodlands Training Center is minutes’ walk away from Woodlands, Woodlands North and Woodlands South MRT stations, as well as Woodlands bus interchange.

It is also easily accessible by the SLE, BKE and upcoming NSE. Food choices are plenty at Wood Square too!

Maximum skills transfer through hands-on on-premise training approach

Rated 4.9 Google Review star ratings stars by more than 17,339 happy learners on Google Reviews

Start Your Learning Journey with FirstCom Academy Today

ENROLL NOW

ENROLL NOW